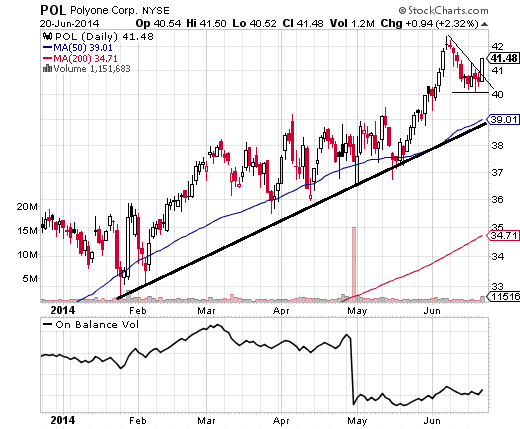

A flag is a small

continuation pattern

and these four stocks recently broke out of one, or are close to it.

Flags provide an entry, stop and target, making them a relatively

straightforward pattern to trade. The pattern is created by a strong run

higher, followed by a small

sideways or downward slanting consolidation, the

flag.

When the price breaks above the flag, initiate a long position, with a

stop below the consolidation/flag. The target is traditionally based on

the height of recent run higher, added to the bottom of the flag.

On-balance volume can also be added to the chart to gauge the strength of trends and legitimacy of breakouts.

Δεν υπάρχουν σχόλια :

Δημοσίευση σχολίου