|

|

Coffee

As mentioned in a previous article,

coffee has been one of the greatest investments so far in 2014. As you

can see from the chart below, the iPath Dow Jones-AIG Coffee Total

Return Sub-Index (JO)

has risen an astonishing 52.67% so far this year. From a technical

perspective, notice how the recent pullback from its swing high of

$42.87 stopped near the long-term support of its 200-day moving average.

This long-term average will likely be used by many traders to help them

determine where to place their stop-loss orders so that they can

maximize the risk/reward of the trade. To help the bullish case for

coffee traders, the recent crossover shown on the MACD indicator

suggests that the next stop could be back toward the mid $40s. (For

more, check out Calculating Risk and Reward)

|

|

|

|

iPath Dow Jones-AIG Coffee Total Return Sub-Index ( JO)

|

|

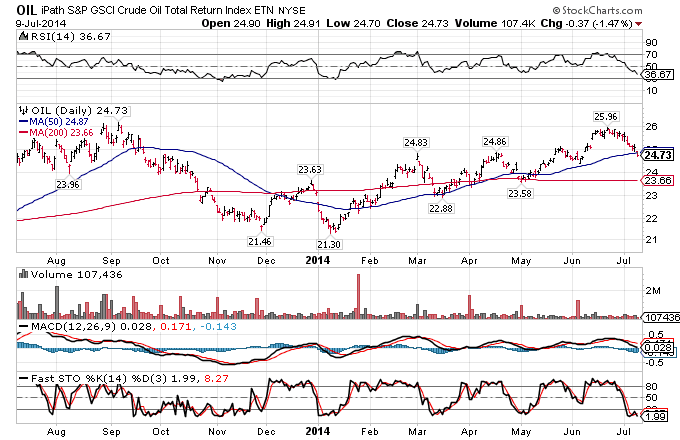

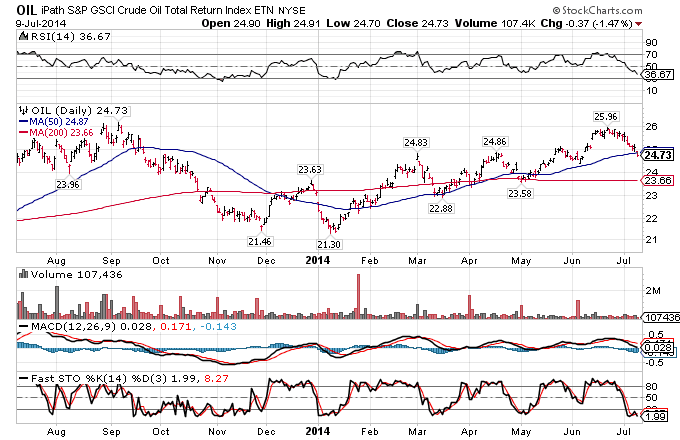

Oil

Recent articles have suggested that higher prices have recently become the reality because of conflict in the Middle East. As you can see from the chart of the iPath S&P GSCI Crude Oil Total Return Index (OIL),

the price has started to pullback from its recent high and appears to

be on route to test the support of its 200-day moving average. As was

the case for coffee traders, most oil traders will also be looking to

enter a trade as close to the 200 DMA as possible because this will

maximize the risk/reward ratio for the position. Taking a look at the

RSI and the MACD indicators would also suggest that there may be some

more short-term selling pressure before the uptrend is able to resume.

Trading signals will be generated when the two indicators create a

bottom and move above the key trigger lines. In the case of the RSI,

traders will want to see a move below 30 and then want to enter a long

position when it crosses back above. For the MACD, a buy signal will be

generated when the MACD indicator crosses above its trigger line (red

line) in the upward direction. |

|

|

iPath S&P GSCI Crude Oil Total Return Index ( OIL)

|

|

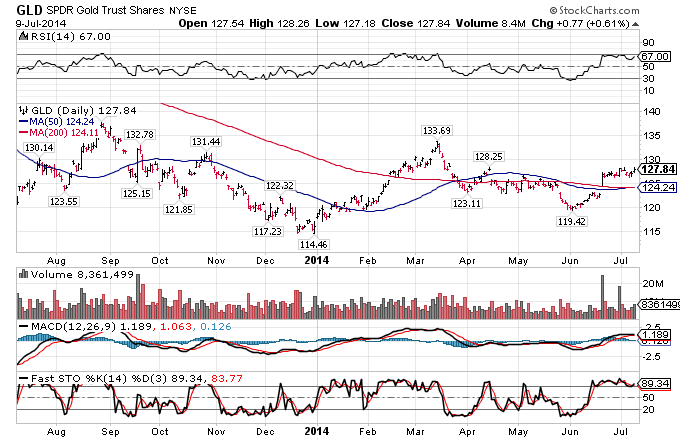

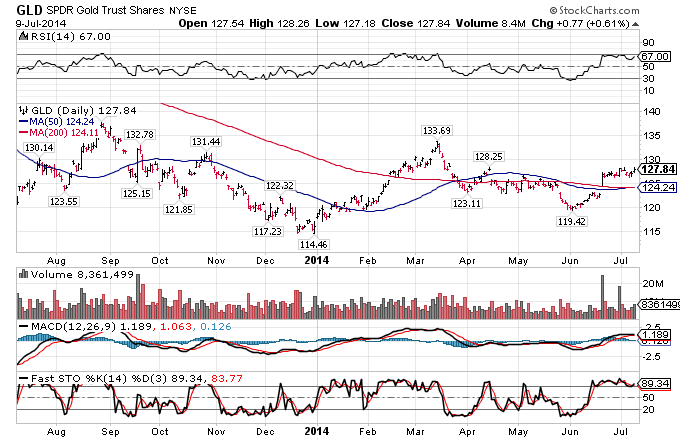

Gold

Gold has been on the rise over the past few weeks and the recent move shown in the chart of the SPDR Gold Trust ETF (GLD)

suggests that we could see a move even higher. As was the case in the

previous examples, it is interesting to see how the price action has

been respecting the support of its 200-day moving average. |

|

|

SPDR Gold Trust ETF (GLD)

|

|

| Conflict in the Middle East,

economic uncertainty and a built in inflation hedge makes GLD a very

interesting pick for any active trader. |

|

Δεν υπάρχουν σχόλια :

Δημοσίευση σχολίου